Explore → DAO Members

Explore → DAO MembersInflationary Rewards

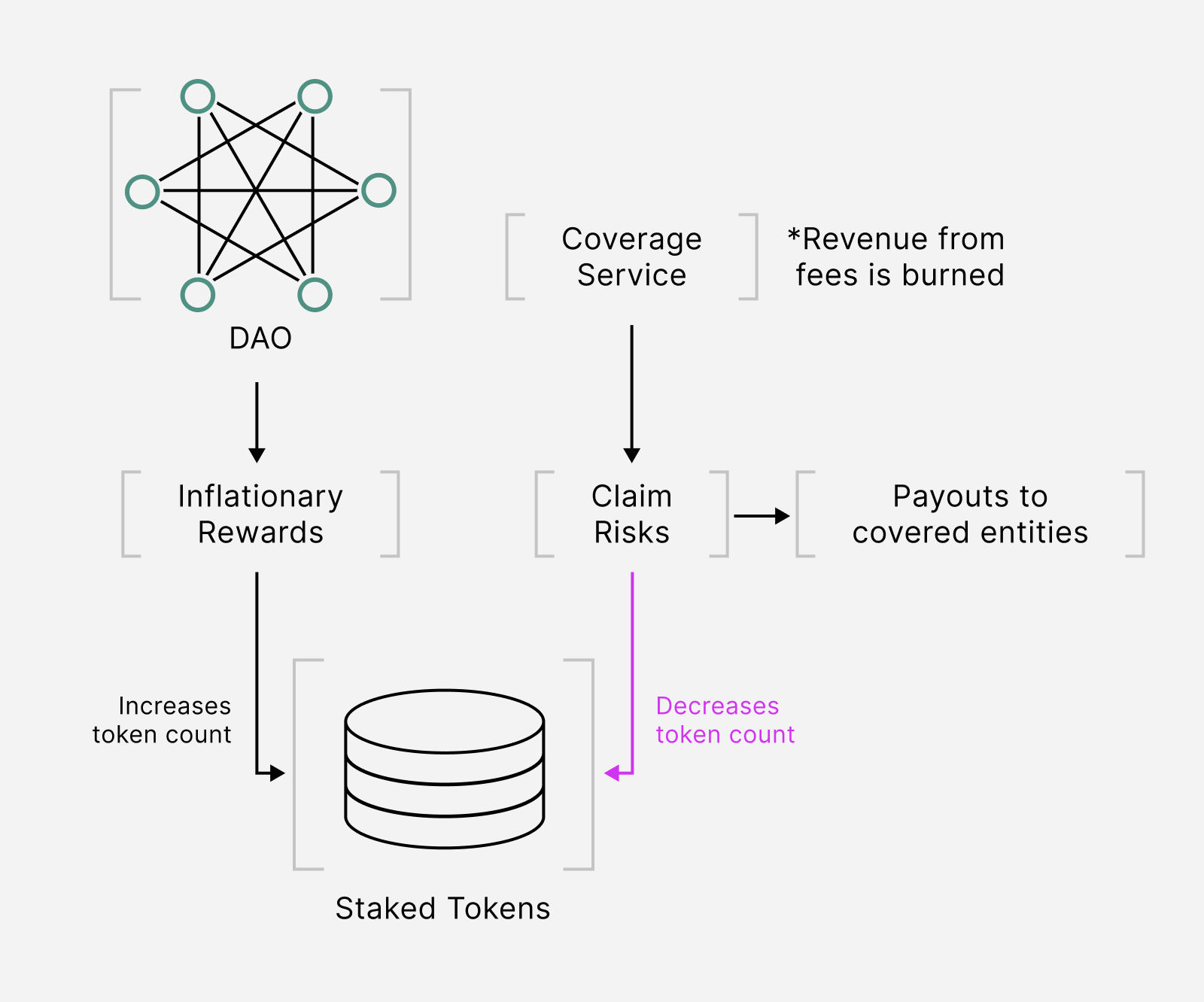

API3 aims to set up, maintain, and monetize dAPIs at scale. API3 generates revenue through on-chain subscription, OEV, and service coverage fees. To align the governance incentives with API3’s success, combined with the inflationary rewards, the net revenue to the DAO is directed to smart contracts which programmatically buy and burn API3 tokens. This mechanic will produce positive staking incentives combined with the inflationary governance rewards, and is balanced with service coverage claim risks.

Fees from revenue are converted to API3 tokens and burned. Inflationary rewards are minted to stakers by the DAO contract. Successful service coverage claims are paid to covered claimants from the pool of staked tokens.

Earning Rewards

Earning inflationary rewards is simple: everyone who has staked API3 tokens into the DAO pool contract to participate in governance will earn rewards as they are minted to the DAO pool. When you schedule tokens to be unstaked, you stop earning rewards for those tokens.

Remember that when you stake, you receive non-transferable pool shares equal to the current total number of pool shares divided by the total number of tokens staked. Since the reward adds additional tokens to the pool, one pool share does not always correspond to one token.

Incentives of Rewards

In essence, inflationary rewards entice token holders to stake and avoid relative dilution of their tokens. However, staking is risky due to the staked tokens being used as collateral for service coverage policies, which encourages the staker to participate in governance to ensure that the risk is minimized. As a combination of the two, an inflationary governance token used as collateral attracts all token holders to participate in governance, which is ideal because it maximizes the decentralization of governance. Inflationary rewards are automatically minted weekly by the DAO governance smart contract. Furthermore, inflationary rewards are locked for a year, which results in governing parties sharing the project’s long term interests.

Reward Calculation And Distribution

The staking reward will float to have the total staked amount reach equilibrium at the target. In other words, the staking reward is programmed to increase while the staked amount is below the target, and vice versa. There is no pre-determined schedule.

Reward amount is represented as APR (annual percentage rate) in API3 tokens. You can derive APY (annual percentage yield) using an online calculator. There is a governable "APR update step", which is the step size each week the APR will be updated with. Also there are governable minimum and maximum APR values, but these (especially maximum APR) are there as safety measures. In general, governing the stake target will be the primary tool for regulating rewards.

Rewards are added as staked API3 tokens into the DAO pool each time the mintReward function is called. mintReward is callable by anyone, once per "epoch" (and single epoch length is 1 week). When it is called, an amount of API3 tokens is minted and added to the DAO pool:

rewardAmount = totalStakedTokens * APR * epochLengthInSeconds / yearInSeconds / 1001(see the smart contract source for more information).

In addition, each time mintReward is called, the annual percentage (the reward rate) is updated up or down by the APR update step size (1%), according to whether the total number of staked tokens is above or below its target. The initial target is 50%, so if the total number of staked tokens is less than 50% of the total token supply when mintReward is called, APR will be raised by 1% for the next reward mint (and vice versa). Thus, APR will constantly be adjusted, but it will always stay between a designated maximum and minimum.

Example

Rewards Distribution User X stakes 600 tokens and user Y stakes 400, so there is a 60% (X) 40% (Y) split ownership in the 1000 token DAO pool. For a particular week the reward mint is 1% (10 total tokens) and the pool is now 1010 tokens. X at 60% now has 606 tokens and Y has 404. Remember that the 10 reward tokens are locked for a period of one year.

Reward Withdrawal

Rewards withdrawals are baked into default withdrawals, except that rewards are locked for 1 year after minting. As a staker, your pool shares will always reflect a proportional claim on the pool of staked tokens, including any rewards that have been minted. When you unstake and withdraw your tokens, you will receive:

- your tokens,

- plus any share of the rewards you earned,

- minus rewards that were added to the pool within the last year, which will remain staked.

To summarize reward withdrawal: you will not be able to withdraw your rewards for a year. Since rewards get minted every week, you can think of this as a rolling unlock (the rewards you receive this week will get unlocked 1 year later, the rewards you will receive next week will get unlocked 1 year 1 week later, etc.) This 1 year-lock is the secret sauce to good decentralized governance, it essentially aligns the incentives of the stakers/governors with the ones of the DAO/project/token for a whole year.

FLEX_END_TAG